Announcement

Collapse

No announcement yet.

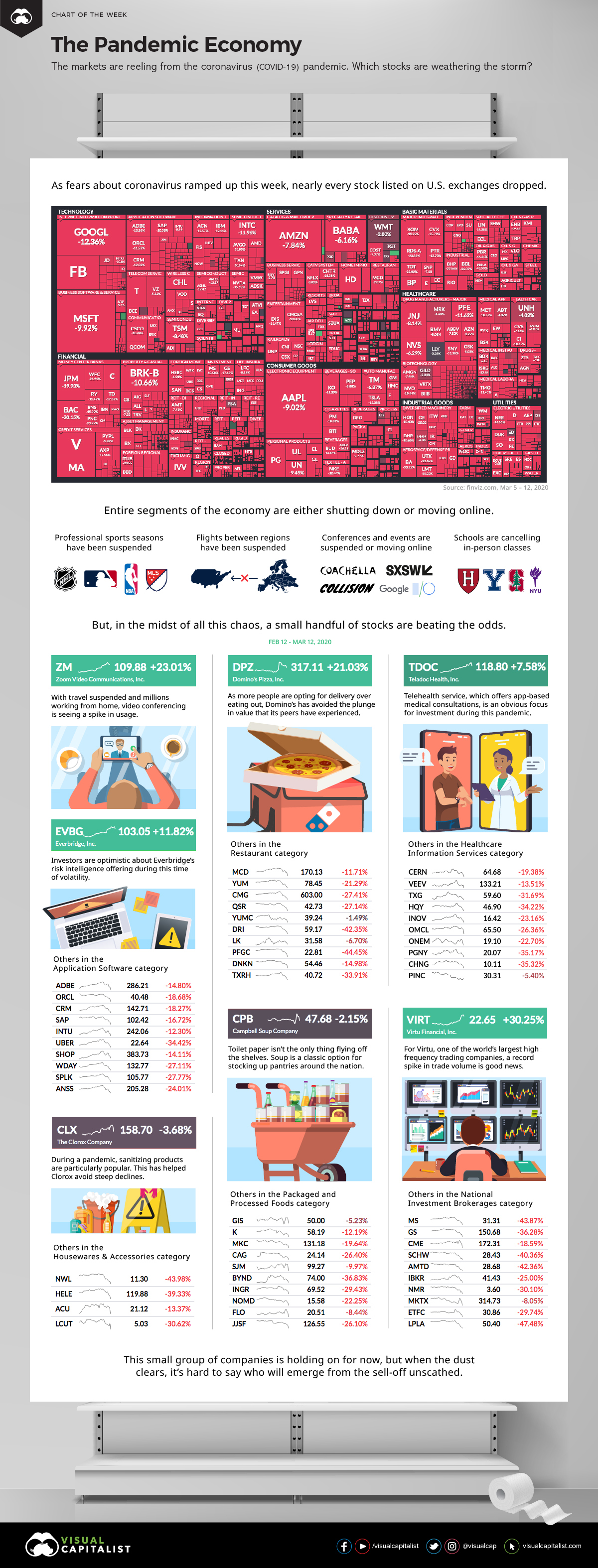

Covid-19 Economic Impact - Visual

Collapse

X

-

never a good idea to "buy tons" of anything at one time. if you do and it starts going lower the emotional response is to panic sell. even though a stock seems cheap, it can always get cheaper.Originally posted by jolter604 View PostWait should I buy tons of apple now?

the better strategy is to scale in slowly say 10-20% at a time with the mindset that if it goes lower you will buy the dips thus bringing your cost average down. never ever try to catch the bottoms or the tops. the best traders in the world can't do that. instead think in terms of risk to reward. by scaling in slow your risk is low even if there is a big drop you still have money on the side to buy it lower.

also, instead of buying just one stock. look into an index ETF like XLK that holds multiple stocks like apple, Microsoft, Visa, adobe, Nvidia etc.. that way you are less vulnerable if apple for example reports lower sales number a particular month and they get a sudden 20% drop. The other stocks in the etf will keep the loss minimal as they wont drop with apple so your loss would be less than just holding apple itself.

markets are designed to take money from the weak/dumb/emotional. if you think like an average Joe you will have your money taken from you I guarantee it. you've been warned. think of the markets not as something that will make you rich, but as an ocean of great whites. the second you show weakness or misjudgment you will be eaten.

- 1 like

Comment

-

case in point. had you bought 10k worth of apple when you made that post, you would be down to 8700 today with apple dropping 13% yesterday alone. this is why it's never a good idea to "buy tons" at one time. the pain if your wrong is often to much for people and they end up selling at a loss because they can't afford to lose more.Originally posted by Bouncer View Post

never a good idea to "buy tons" of anything at one time. if you do and it starts going lower the emotional response is to panic sell. even though a stock seems cheap, it can always get cheaper.

the better strategy is to scale in slowly say 10-20% at a time with the mindset that if it goes lower you will buy the dips thus bringing your cost average down. never ever try to catch the bottoms or the tops. the best traders in the world can't do that. instead think in terms of risk to reward. by scaling in slow your risk is low even if there is a big drop you still have money on the side to buy it lower.

also, instead of buying just one stock. look into an index ETF like XLK that holds multiple stocks like apple, Microsoft, Visa, adobe, Nvidia etc.. that way you are less vulnerable if apple for example reports lower sales number a particular month and they get a sudden 20% drop. The other stocks in the etf will keep the loss minimal as they wont drop with apple so your loss would be less than just holding apple itself.

markets are designed to take money from the weak/dumb/emotional. if you think like an average Joe you will have your money taken from you I guarantee it. you've been warned. think of the markets not as something that will make you rich, but as an ocean of great whites. the second you show weakness or misjudgment you will be eaten.

Comment

-

Infection Trajectory: See Which Countries are Flattening Their COVID-19 Curve

https://www.visualcapitalist.com/inf...covid19-curve/

Comment

-

Coronavirus Threatens More Than 15 Million U.S. Hospitality Jobs

Waitresses, hotel housekeepers and casino dealers are among the more than 15 million hospitality jobs in U.S. cities at riskfrom restrictions being put in place to deal with the spread of Covid-19. This is based on a Bloomberg News analysis of the latest available U.S. Bureau of Labor Statistics data through May 2018 covering 40 occupations critical to America’s hospitality and gaming industries.

https://www.bloomberg.com/graphics/2.../?srnd=premium1 Photo

Comment

Comment